ESG: Beyond the Reports

Harnessing Data for Real-World Impact

21st March February 2024

Environmental, Social, and Governance (ESG) factors have become crucial to modern business operations and investment decisions. Today, various stakeholders, from consumers to regulators, demand evidence of demonstrable action on ESG priorities. However, despite the growing importance of ESG, many companies still confine it to mere compliance exercises and annual reports, failing to realize its full potential.

To unlock the benefits of ESG, companies must transition from a reporting-focused approach to a comprehensive data-driven strategy. This shift requires innovative platforms like TRST01 Footprint, which provide comprehensive insights into ESG data and enable decisive action. By leveraging such platforms, businesses can develop a more comprehensive understanding of their ESG performance and improve their impact on the environment, society, and governance.

The Pitfalls of ‘Greenwashing’ and the Need for Transparency

As the world becomes more conscious of environmental concerns, companies are under increasing pressure to present themselves as environmentally responsible. However, there is a growing risk of “greenwashing,” which refers to the practice of presenting a falsely positive image of a company’s environmental impact.

It is important to note that traditional ESG (Environmental, Social, and Governance) reporting, which is designed to give information about a company’s environmental and social performance, needs to be reconsidered. The present approach of selective disclosure, where only positive information is presented, or the lack of rigorous verification, can lead to inaccuracies. Such inaccuracies can unintentionally contribute to greenwashing, which is something we must avoid.

To build credibility and the trust of stakeholders, companies must prioritize transparent and reliable ESG performance data. They must ensure that their disclosures are accurate, complete, and verifiable. By doing so, they can demonstrate their commitment to sustainability and gain the trust of consumers, investors, and other stakeholders.

TRST01 Footprint: Raising the Bar for ESG Management

TRST01 Footprint addresses the fundamental challenges of traditional reporting and compliance with its multifaceted capabilities:

- Global Alignment and Comparability: The TRST01 Footprint is a cutting-edge tool that ensures compliance with widely accepted sustainability reporting standards, including GRI, BRSR, SGX, SASB, and TCFD. By adhering to these international standards, TRST01 Footprint promotes consistency and comparability across different industries and geographical regions, facilitating informed evaluations by investors and other stakeholders. This means businesses can easily demonstrate their commitment to sustainability while stakeholders can better understand environmental, social, and governance (ESG) risks and opportunities. Ultimately, the TRST01 Footprint helps to create a more sustainable and equitable future for all.

- Actionable Insights and Predictive Analytics: Footprint’s cutting-edge analytics and state-of-the-art AI-powered modelling allow for the transformation of unrefined data into practical recommendations that can be used to guide businesses towards a more sustainable and socially responsible future. Through the use of this technology, companies are able to identify and prioritize areas that require environmental, social, and governance (ESG) intervention, establish science-based targets, anticipate possible risks, and develop proactive mitigation strategies.

- Deep Supply Chain Visibility: TRST01 Footprint is a comprehensive tool that offers businesses advanced supply chain reporting capabilities. With this tool, companies can gain insights into their environmental, social and governance (ESG) risks and identify hotspots that exist across multiple tiers of suppliers. This information can be used to foster collaboration on sustainability initiatives throughout the value chain, ensuring that businesses operate in a way that is environmentally responsible and socially sustainable. By taking into account the indirect impacts that can often overshadow direct operations, TRST01 Footprint empowers companies to make informed decisions that benefit not only their bottom line but also the planet and society.

- Unparalleled Transparency with (Optional) Blockchain Security: TRST01 Footprint offers an (optional), blockchain technology. This creates an immutable ledger of a company’s ESG data, guaranteeing its authenticity, traceability, and auditability. While not mandatory, this additional layer of transparency fosters exceptional trust with stakeholders, reinforces confidence in a company’s ESG practices, and positions them as frontrunners in sustainability and responsible governance.

ESG in Practice: Driving Sustainable Transformation Across Industries

TRST01 Footprint’s industry-agnostic approach empowers companies in diverse sectors like FMCG, cement, chemical, steel, BFSI, Pharmaceutical and many more to achieve transformative ESG outcomes. Here are some specific examples:

- FMCG: TRST01 Footprint technology presents a promising opportunity for consumer goods companies to achieve higher levels of sustainability and environmental responsibility. By incorporating this innovative solution into their manufacturing processes, companies can significantly reduce the amount of waste generated, minimize their carbon footprint, use eco-friendly materials, and conserve water resources. This benefits the environment and enhances the reputation of these companies as responsible and ethical corporate citizens.

- Cement: TRST01 Footprint aligns seamlessly with the Global Cement and Concrete Association (GCCA) Framework, demonstrating practical solutions for global construction challenges and sustainable development goals. It promotes responsible industrial leadership in sourcing, manufacturing, and using cement and concrete. Cement manufacturers can leverage this platform to identify and mitigate air pollution risks, adopt energy-efficient technologies, and investigate alternative fuel sources.

- Chemicals: As a chemical company, you can greatly benefit from gaining detailed insights into your operations’ environmental impact. By doing so, you can prioritize reducing hazardous waste and promoting safe chemical handling practices throughout your entire organization. These efforts can help protect the environment and improve the safety of your employees and the community you serve. With the right approach, you can establish a culture of sustainability that benefits both your company and the world around you.

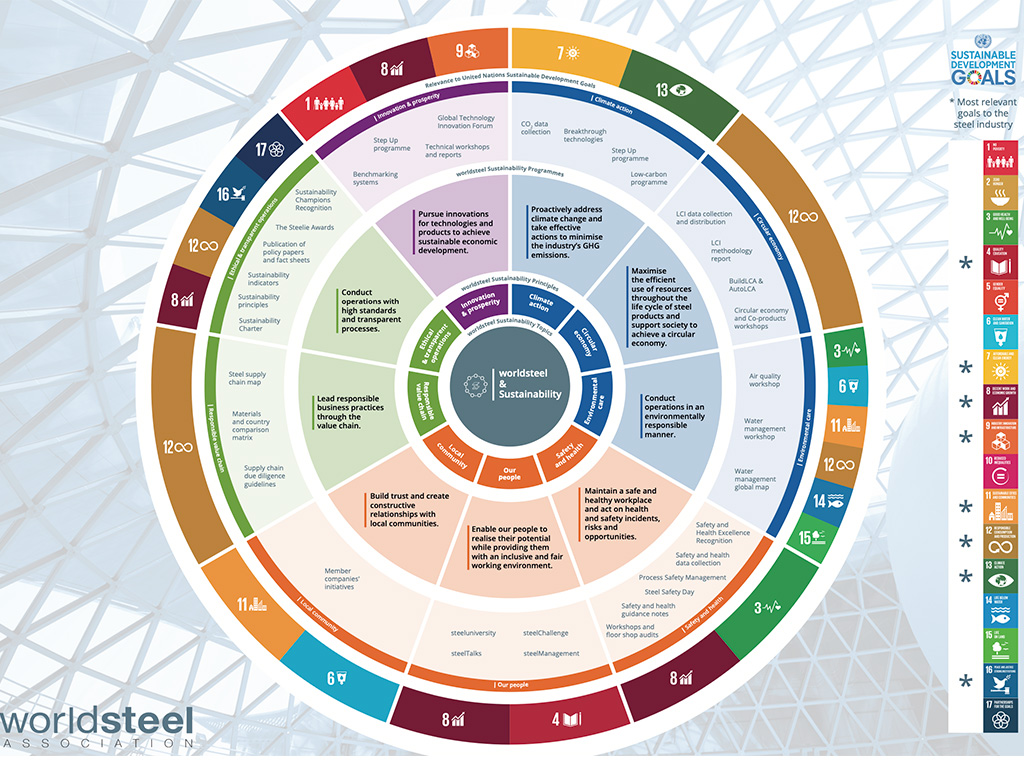

- Steel: The cement industry is responsible for about 7% of the global CO2 emissions, making it the third largest CO2 emitter worldwide. If the cement industry were a country, it would be surpassed in CO2 emissions only by China and the US, with up to 2.8 billion t. Despite this, cement is a crucial material needed for safe and affordable housing and infrastructure, particularly with the growing population and accelerating urbanization, as well as the effects of climate change. Therefore, the cement industry has a unique opportunity to have a positive impact. Worldsteel Association (WSA) has introduced nine sustainability principles, including objectives and criteria for ESG (environment, social and governance) topics. Steel producers can use TRST01 Footprint to identify ways to reduce water consumption in steelmaking processes, decrease greenhouse gas emissions, and ensure the responsible sourcing of raw materials.

- BFSI: BFSI institutions, encompassing banks, financial services firms, and insurance companies, harness the power of ESG platforms to achieve many benefits. These platforms are instrumental in meticulously assessing loan portfolio environmental, social, and governance risks. This allows BFSI institutions to make informed decisions and potentially mitigate risks associated with unsustainable practices. Additionally, they leverage the platform to identify and invest in sustainable infrastructure projects, promoting environmentally conscious development. Furthermore, BFSI institutions utilize these platforms to drive financial inclusion by extending financial services to unbanked communities. This is achieved through innovative solutions tailored to their needs, fostering economic empowerment and societal well-being. Notably, in India, the RBI’s mandate for Asset Management Companies (AMCs) to invest a substantial portion (80%) of their AUM in ESG-compliant companies further underscores the growing importance of integrating ESG considerations into BFSI operations. This regulatory push, coupled with the capabilities of ESG platforms, paves the way for a more sustainable and inclusive financial landscape.

- Pharmaceutical Sector The pharmaceutical sector faces unique ESG challenges, ranging from responsible sourcing of active pharmaceutical ingredients (APIs) to ethical drug development and clinical trials. TRST01 Footprint can be instrumental for pharma companies in tackling these complexities. The platform’s in-depth supply chain mapping enables the tracing of APIs, ensuring their sustainable and ethical procurement. It facilitates rigorous data collection and analysis of clinical trial practices, safeguarding human rights and promoting patient well-being. Additionally, TRST01 Footprint can help pharma companies track and minimize their environmental footprint throughout their operations, including energy use, waste disposal, and water management. By providing data-backed insights and enabling transparent ESG reporting, TRST01 Footprint empowers meaningful ESG progress and stakeholder accountability within the pharmaceutical industry.

The Future: ESG as a Source of Competitive Advantage

TRST01 Footprint is an advanced ESG (Environmental, Social, and Governance) solution that helps businesses exceed the minimum reporting requirements and embrace sustainability as a driver of efficiency, innovation, and risk management. Companies that can demonstrate robust ESG performance are better equipped to succeed. Businesses can ensure their operations are sustainable and responsible by identifying and addressing potential ESG issues across the 4Rs framework (Risk, Reward, Regulatory, and Reputation).

- Mitigate Risks: companies can safeguard their operations from disruptions, financial losses, and reputational damage. TRST01 Footprint’s analytics help organizations proactively manage risks associated with issues like climate change, labor practices, and supply chain vulnerabilities, enhancing their overall resilience.

- Rewards Attract Socially Conscious Investors: A growing segment of investors prioritizes ESG performance alongside financial returns. Data-backed ESG initiatives make a company more appealing to this expanding investor base.

- Enhance Brand Reputation: Consumers are increasingly discerning, favouring brands aligned with their values. Proactive, transparent ESG actions can bolster brand loyalty and customer trust.

- Strengthen Regulatory Compliance: As ESG regulations evolve globally, companies using tools like TRST01 Footprint gain a proactive edge in preparing for and adapting to new standards.

Conclusion

In today’s rapidly evolving world, Environmental, Social, and Governance (ESG) considerations are no longer optional—they have become necessary for long-term business success. Platforms such as TRST01 Footprint play a crucial role as catalysts for action, providing reliable data and actionable insights to help companies translate their ESG commitments into tangible, positive impacts both within their operations and the wider world.

Recent Comments

Recent Posts

- Driving Global Impact: Regulation, Technology, and Adoption July 14, 2024

- Blockchain Revolutionising Provenance Global Supply Chains July 11, 2024

- Supply Chain Innovation TRST01Chain June 18, 2024

- Blockchain for Sustainability June 14, 2024

- EUDR Coffee : Between the Cup and the Lip June 9, 2024

- EUDR and India Rubber Export May 25, 2024

- Data Driven Sustainability April 28, 2024

- Paradigm Shift in ESG April 14, 2024

- ESG Beyond the Reports March 21, 2024

- The Kenko Eggs A Case Study February 18, 2024

- New Frontier : Carbon Broader Adjustment Mechanism (CBAM) January 27, 2024

- Sustainable Transformation Future ESG Management January 21, 2024

- EUDR Compliance in Indian Trade January 7, 2024

- The Indian Coffee Story : Brewing Harmony December 16, 2023

- The Rubber Story : Between Growth and Sustainability December 10, 2023

- The 4R Strategy : Roadmap to Sustainable Growth December 3, 2023

- Sustainable Indian Coffee: A EUDR Perspective November 10, 2023

- Climate Tech and SDGs: Unlocking Potential October 21, 2023

- ESG Scorecards : TRST01’s Vision October 11, 2023

- The Imperative of Carbon Accounting October 8, 2023

- TRST01Chain on International Coffee Day October 1, 2023

- Footprint Lite – Embracing SME September 24, 2023

- Footprint ESG – Embracing Enterprise September 14, 2023

- Empowering Tomorrow: Innovation, Pivoting, and Sustainability at TRST01 August 27, 2023

- TRST01Chain for Scope 3 Reporting August 12, 2023