Knowledge Share

New Normal, Digital Transformation, Industry 4.0

Trust | Transparency | Traceability

Insurance Sales and Blockchain

20 October 2020

India, with all its diversity in income patterns, education levels, occupations, etc., is a vast experimental playground for insurance products while focusing on the most financially vulnerable. Collaboration and disruptive emerging technologies will serve as a forum for innovation and value proposition; this is need at this juncture for a more economically inclusive society.

The Primary Sales channel for any Insurer till now is through an Insurance Agents. Since the start of the InsurTech movement, the role of agents has become crucial. Anyone who assumed to replace agents with automation and AI, and excludes those agents from the distribution chain are missing a critical part of the industry. To remain relevant, customers, agents and carriers must embrace emerging technology along with maintaining its personal touch. Agents who bring profitable business to pages are still valued and integral part of the insurance distribution chain.

At the heart of Blockchain-technology is a distributed ledger. The blockchain’s distributed ledger is a great way for insurers to collaborate and track suspicious behaviour. The transparent nature of blockchain enables a greater degree of trust fostered upon either of parties. It allows insurers to record transactions permanently and makes it easier to detect key fraud patterns, such as:

- Double booking (of multiple claims from one incident)

- Counterfeiting

- Premium diversion

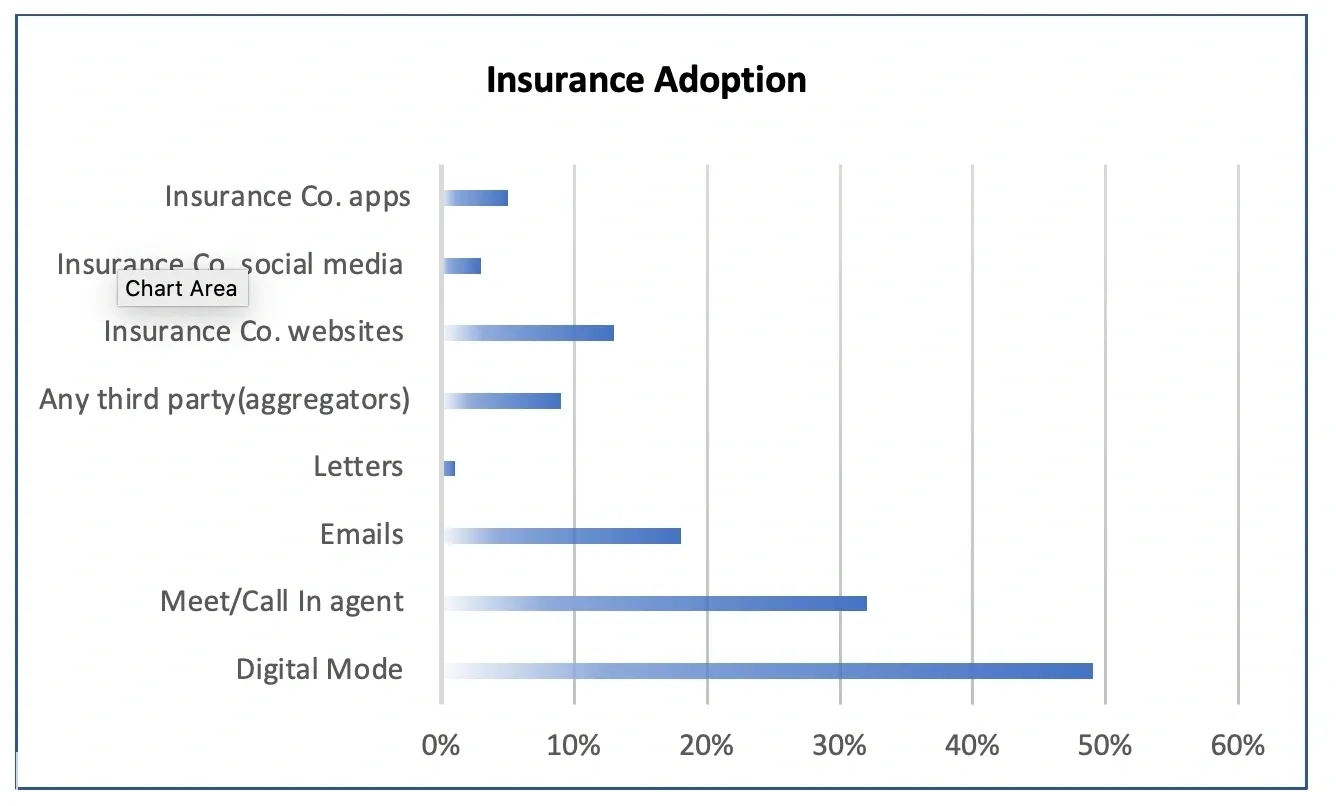

46% of insurers expect to integrate blockchain in the next two years, and that 84% of insurers identify that blockchain and smart contracts can revolutionise the way that they engage with new partners. Emerging technology (such as AI-enabled chatbots) has already started picking up as the customer’s first point of contact. Therefore, it has the potential to expand to multiple phases of customer engagement in due course of time, as the findings can see the adoption rate of a PWC report for the year of 2019-20.

Trust works on both ways as not all claimants are trustworthy and, not all tell the truth when making a claim. However, still today in India, the last purchase decisions and settlement of an insurance product happens after final consultation with an agent. Agents’ behaviour is critical in this market to build trust, as approximately 90% of insurance purchased through agents.

Contributor Prateek Bebortha, Business Analyst ETgarage

Share Blog on: