India’s national forest policy suggests a national goal of bringing 33% of the country’s geographical area under forest and tree cover in the plains, while 66% of the area should be under forest cover in the hilly regions. The National Forest Policy is currently under review, and the draft of the new policy aims to bring 33% of the government-owned forests under a community forest management regime by 2030. It also intends to double the tree cover area outside forests by 2030. Another objective of the draft policy is to integrate climate change mitigation and adaptation measures in forest management and enhance the carbon sequestration in forests and trees by 33% by 2030.

India’s forest and tree cover increases and accounts for 24.56% of the total geographical area.The forest and tree cover sequester about 16% of India’s annual carbon dioxide emissions. India has an impressive but ambitious NDC goal of creating an additional carbon sink of 2.5 to 3 billion tonnes CO2e through other forest and tree cover by 2030.

Carbon Offsets Value Creation on Blockchain

News Flash!

The social forestry division of the Gujarat forest department has identified agroforestry plantations spread over 11,150.2 ha across Anand, Kheda, Mehsana, Panchmahal, and Bharuch for the proposed project. These plantations have been done on land belonging to 9,781 farmers living in 948 villages.

About hundred-odd villages in Uttarpadep their carbon credits, thanks to dense tree cover near villages, is worth almost Rs 70 Lacs that can be encashed for five years.

Above mentioned news is factually correct, now, the renewed fact is Opportunities are knocking at our doors in our state

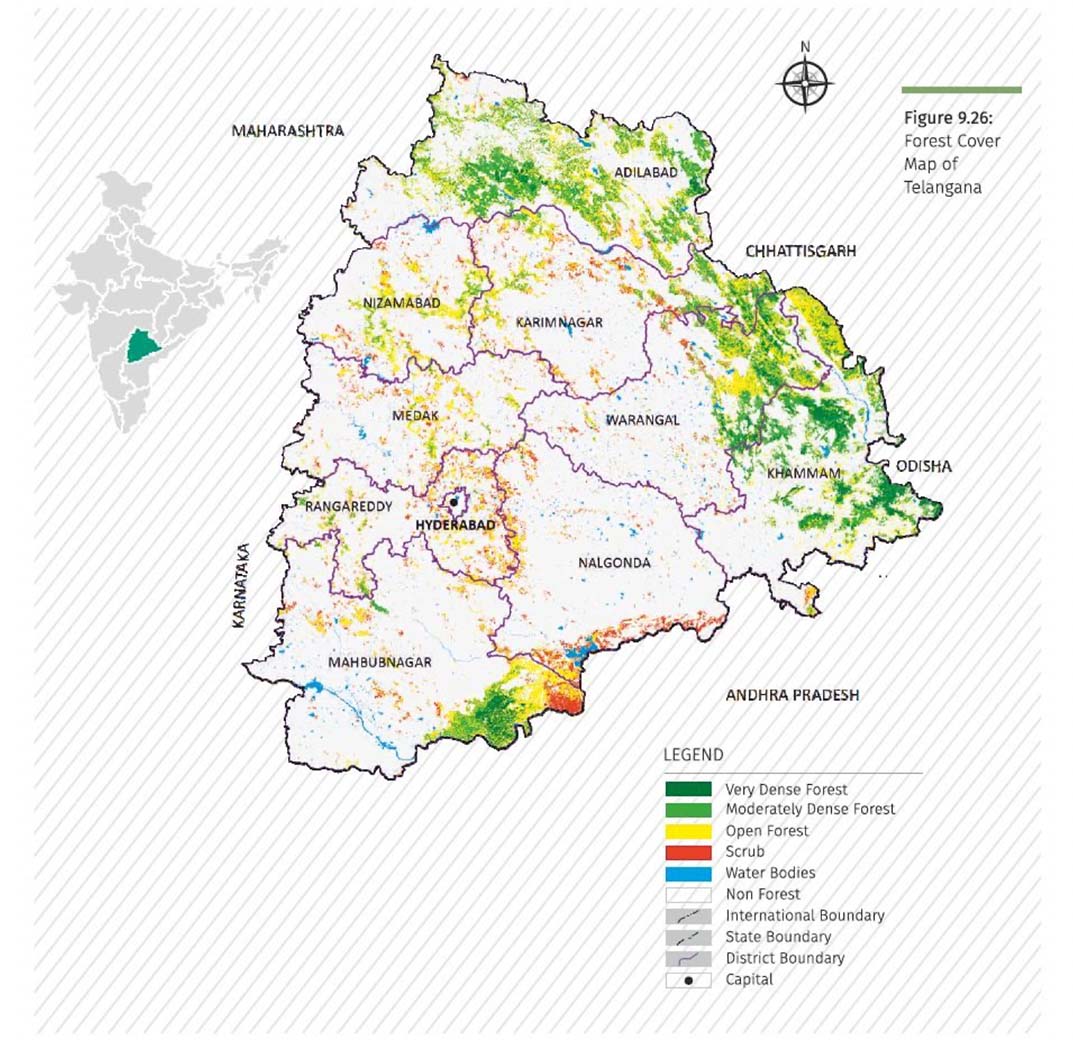

Telangana has 27,43,000 ha. of forest cover, which accounts for 24% of its geographical area. The report says the total carbon stock of the forest in the state is 184,975 million tons (equivalent to 678,242 million tons of CO2 Equivalent ). Its flagship program, Telanganaku Haritha Haram, has increased forest cover by a 3.67%. Telangana Government is using Drone for aerial seeding solutions for rapid and scalable reforestation. The project uses drones to disperse seed balls over thin, barren, and empty forest lands to turn them into lush green abodes of trees. The process begins with a field survey and mapping the terrain to understand the ecosystem and identify the areas that need urgent attention. This is used to determine the number and species of trees that can be planted based on the soil, climate, and other parameters.

This effort by the state provides an excellent “Additionality” factor for carbon sequestration and provides the state with a perfect continued earning opportunity.

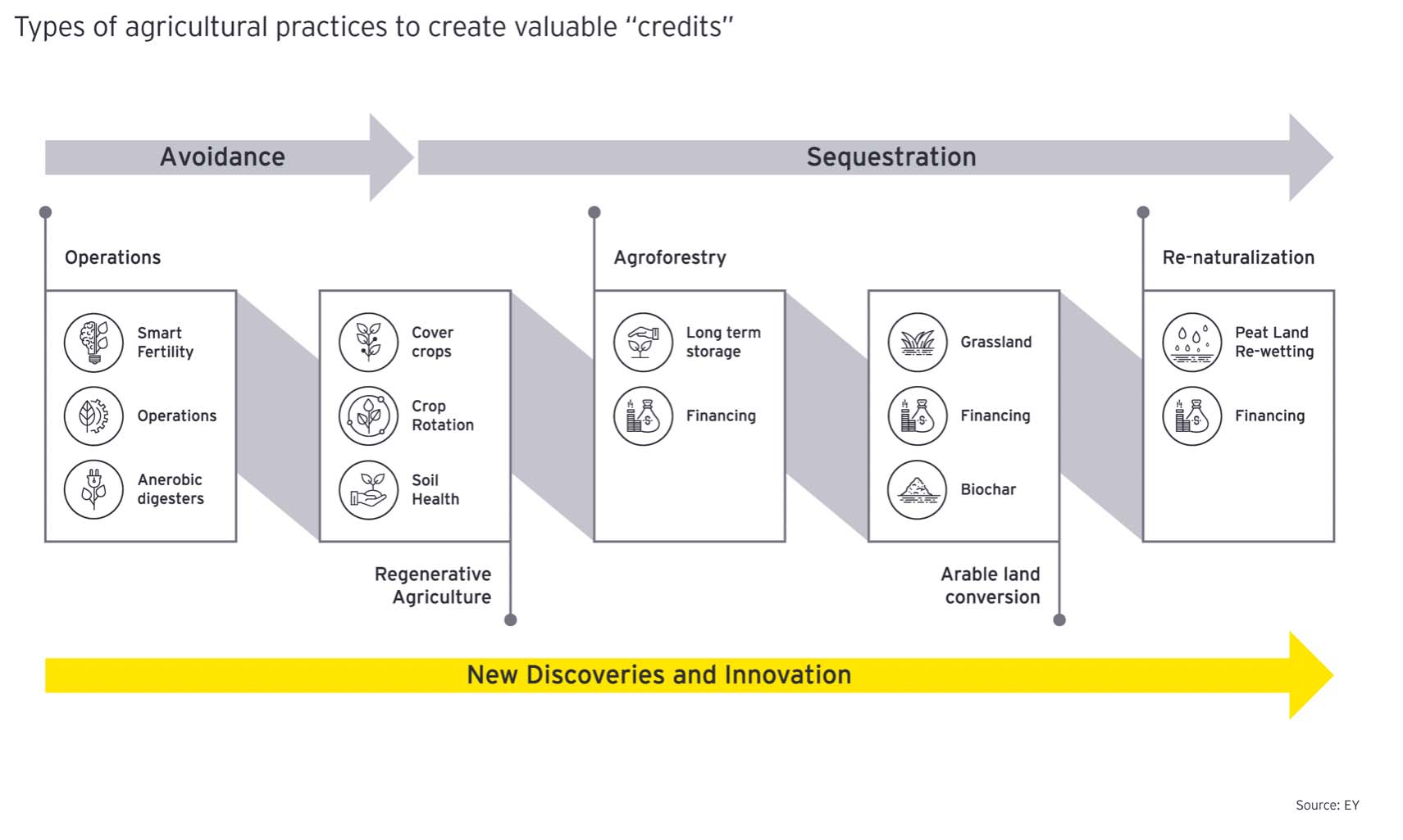

Tackling climate change requires a reduction in atmospheric carbon dioxide. Among other measures, Sustainable Agriculture practices, Afforestation, Changing the energy consumption pattern helps in reducing GHGs. Farming practices can sequester Carbon from Atomosphear and improve soil health simultaneously. Crop rotations, Reduced tillage, Green manure, and Agroforestry increase carbon sequestration in the soil and perennial vegetation. Longer-term, they also increase farm revenue. However, smallholders have not yet widely adopted such practices. One primary reason is their need for an immediate return on investment. Therefore, the challenge is to bridge the gap until farmers benefit financially. Payments for ecosystem services can encourage them to adopt more sustainable practices.

The Driver

Article 6 of the 2015 Paris Agreement, the provision determining how countries can reduce emissions through carbon credit trading, was a primary focus of COP26. In the conference’s final hours, long-awaited agreements were made on rules that govern international carbon markets.

One key agreement at COP26 aims to avoid double-counting credits traded across borders by creating a verification system under the UN that ensures one credit counts towards one country’s nationally determined contribution, then is removed from the country’s emission accounting if it is sold.

India is a leading country in international carbon markets reviving upon implementing the Paris Agreement, post-2020. The carbon market is volatile and has many associated risks, and the new markets have higher risks than established and mature markets.

According to NatWest Markets, the international market for climate finance is projected to reach $640 billion this year, and companies such as Walmart, Amazon, Nestlé, Alibaba and Mahindra Group are pledging to slash emissions and invest in nature as a carbon sink. Demand for forest carbon offsets could outstrip supply by 2025, and carbon prices could quadruple by 2030, and offset values could be worth $125 billion to $150 billion a year by 2050.

Carbon Voluntary market Opportunities

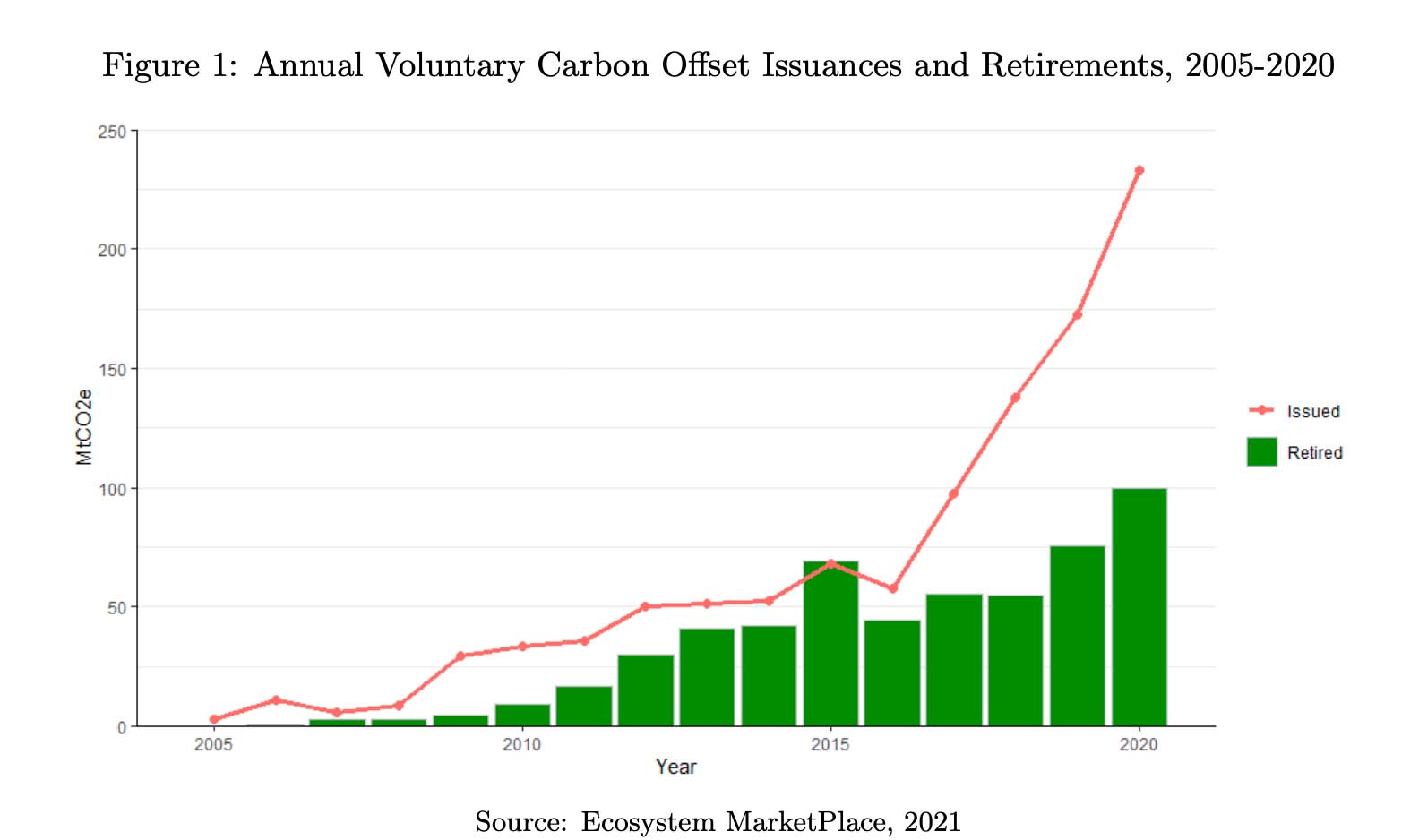

Carbon offsets operate in both compliance and voluntary markets. The former is subject to tight regulation and supervision by national governments and international bodies. In contrast, voluntary markets are not defined by specific caps, and firms are free to choose which projects they wish to invest in. However, the voluntary market as a whole has been relatively minor for most of its history. Still, it has started to overgrow in recent years, driven by company commitments and anticipation of future regulation.

The voluntary carbon offset market is expected to grow to $100 billion by 2030, up from $300 million in 2018 as firms commit to net-zero targets, but without the internal ability (or will) to reduce emissions directly within their supply chain race to purchase offsets. For some sectors, such as aluminium, offsetting is the only credible pathway to net-zero giving the existing technology. A surge matches this surge in interest in voluntary carbon markets in developing sustainable supply chains, especially regarding agricultural commodities. Net-zero targets (and sustainable supply-chains) met through offsetting are credible only so that the offset credits involved are valid, permanent and additional. Determining this requires transparency over the nature of the project, and this transparency will, in turn, bring credibility to offsets and net-zero targets.

Forest Carbon offset within Voluntary Carbon Market.

Forest and other land-use projects have historically played a much more significant role in voluntary than compliance markets. Forestry activities accounted for 38%, or almost 41.5 MtCO2e, of all carbon offset projects in 2019, with avoided unplanned deforestation initiatives alone accounting for more than 22 MtCO2e.

Despite accounting for a large share of the voluntary market, forest carbon offsets have several challenges on verifiabilities, permanence, additionality leakage, transparency, vague, expensive, and high transaction fees.

Modern technologies in forestry carbon projects

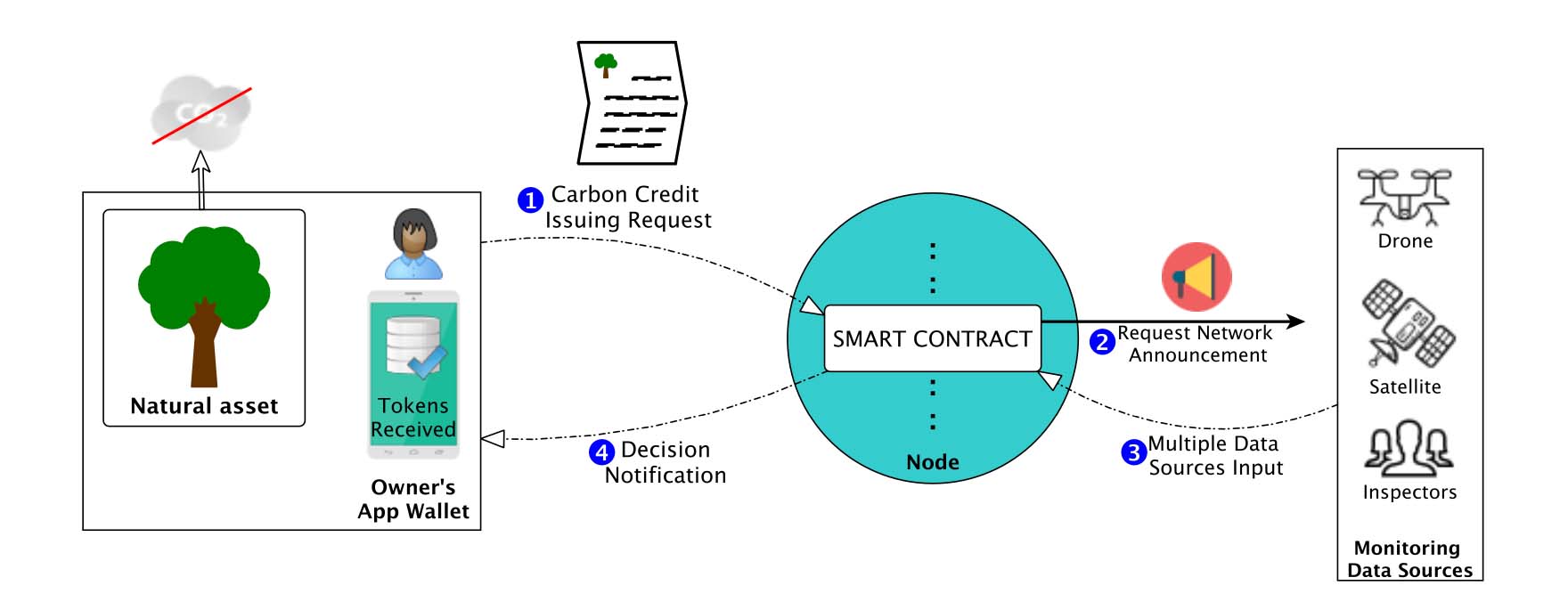

The integration between carbon markets and Blockchain technology has already begun. Even though still in the proposal and pilot stages, the number of forestry projects utilizing blockchain technology is increasing. This trend is not surprising as the technology enables decentralized communication and cooperation between multiple unknown parties by building an infrastructure that allows peers to share, validate and immutably store information safely. Applying this solution to carbon markets could provide a transparent digital means for an automated decentralized verification process of issuing, monitoring, and even revoking carbon credits, boosting demand and reducing issues concerning transactions, verifiability, permanence and leakage.

‘Digital twin’ and Blockchain-enabled platform will reveal how much any project component absorbs or displaces CO2 and its SDG indicators. Using ground observation data and remote sensing images, TRST01 aim to build a carbon model to base a token marketplace that will help corporate meet their carbon offset demand.

The long term proposal is for tokens will be used to trade, compensate for a CO2 footprint, or contribute to climate goals that can also be mapped by using our blockchain platform. These tokens can be bought and held as an investment or burned to offset a company or individual’s carbon footprint. Additionally, it will establish the usage of NFTs to digitize and facilitate the trading of tokenized carbon credits to increase the global carbon offset market’s transparency and liquidity.

Blockchain can facilitate this process at almost zero transaction costs for environmentally aware stakeholders, who might be willing to buy such tokens offsetting their carbon footprint and destroying them to address climate change further.

References

- Understanding Voluntary Carbon Markets | S&P Global.

- TRANSPORT CRITERIA – Climate Bonds.

- Economic Times

- Forest carbon offsets over a smart ledger Grammateia Kotsialou∗ Karlygash Kuralbayeva

- EY

Write to us journey@trst01.com

Share Blog on: