Knowledge Share

New Normal, Digital Transformation, Industry 4.0

Trust | Transparency | Traceability

Decentralised Finance (DeFi)

23 March 2020 | Blockchain, Fintech

During this challenging calamity period of COVID-19, many domain areas in the market are operating on contactless and digital mechanisms reducing the space and time of physical interaction or real-time meetings and confrontation. A lot of traction and improvements are visible in Neo Banking, Contactless Delivery, Work from Home facilities etc. A lot of these things are building upon Digital Infrastructure. Nowadays, banks have issued briefings and notices to customers to focus on more usage of digital facilities rather than physically coming up to the branches.

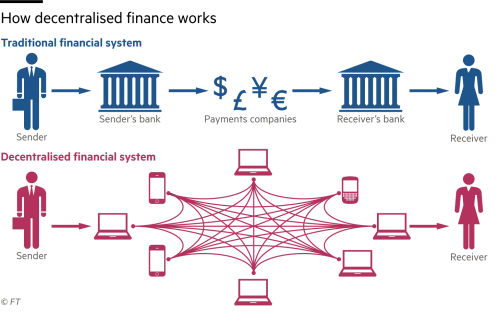

In the last ten years, Fintech 2.0 or Decentralized Finance(DeFi) has been slowly chipping away at banks’ profits by cutting out intermediaries and serving customers directly. 2019 was the year of Decentralized Finance (DeFi). Neo banks focused on creating a better banking interface using open banking APIs or building a core banking system. The objective with DeFi is to build a multi-faceted financial system native to crypto that recreates and improves upon the legacy financial system. DeFi now represents a new fintech wave, and DeFi neo banks will play a pivotal role to successfully bridge the gap between fintech and DeFi to attract new customers.

Decentralized Finance is a brand new monetary system that is built on public blockchains. The components of this finance model consist of protocols, digital assets, dApps and smart contracts, which are built on Blockchain. Before introducing blockchain solutions, the term “fintech” was widely applied to companies that provided modern-looking interfaces while still depending on legacy financial technologies used by banks (ACH, SWIFT). DeFi represents a broad category of financial applications developed on open, decentralized networks. DeFi has grown into one of the most active sectors of Blockchain with applications ranging from stable coins, decentralized exchanges and wallets, to payment networks, lending and insurance platforms.

The Decentralized Finance (DeFi) market is growing and moving forward. Virtual currencies are expanding, and the DeFi market uses this opportunity to reach a more significant number of users. Let’s hope this kind of crisis will enable more such technology to be adopted sooner entirely under Neo networks with digital infrastructure built upon Blockchain.

Reference

https://www.coindesk.com/when-defi-meets-neo-banking-this-thing-gets-interesting

Author: Prateek Bebortha

SAATRA Capital Advisory LLP

Share Blog on: